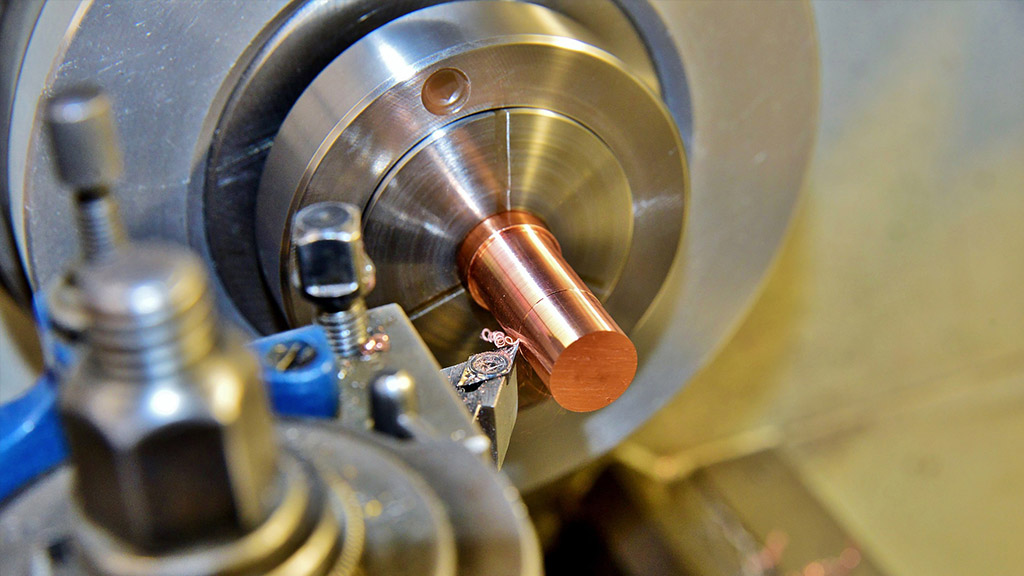

Company: Engineering Business

Type of Work: Administration and Pre Pack

Overview

Our client was the director of the engineering company in financial difficulties, due to bad debts incurred from their customers.

The company was long established and had 10 employees, however, it had experienced difficulties with other companies (customers) going into insolvency proceedings, resulting in bad debts being suffered.

My Insolvency were called in over the Christmas period as the company was under extreme pressure from its various creditors. The business had historically been supported by way of an overdraft facility and loans injected by the director and his family.

With our help and assistance, the director:

- acquired the business from the Administrator

- obtained additional lending organised by our brokerage

- installed controls and systems to minimise the risk of future bad debts

Solution

Upon a review of the business, it was apparent that the company could no longer continue to trade in its current form, without a significant injection of capital to bridge the gap caused by the bad debts. The pressure from the landlord, creditors and the crown made it essential for immediate action to be taken.

In order to protect the business, maximise realisations for the benefit of creditors and save jobs, it was necessary to put the company through an insolvency process. My Insolvency assisted the director and introduced the Board to an Insolvency Practitioner to deal with the administration of the business.

My Insolvency worked alongside the director and assisted him to ensure that the company could continue to trade in a limited capacity, whilst the Administrators undertook their duties, in advance of a successful sale of the business.

Result

The sale of the company was achieved as a going concern to the director’s other company, ensuring:

- All 10 employee’s jobs were saved.

- Minimising bad publicity for the business and protecting its goodwill with the customer base, by ensuring the work in progress was transferred and completed, warranties were fulfilled by the new company and future contracts were novated to the purchaser.

- By completing contracts, this minimised potential counter claims arising from customers, thereby enhancing the realisations for the Insolvency Practitioner dealing with the Administration and ultimately providing a better return for creditors as a whole.

- The personal guarantee exposure of the director was removed as the Bank was repaid in full from realisations.

Following the sale, My Insolvency assisted the ongoing business with installing a credit control function to deal with future collections through My Debt Recovery.

Finally, to ensure that the future business could trade in the long term, My Invoice Finance provided assistance in obtaining finance for the ongoing business.